With surging inflation, there has been a renewed interest in lessor known United States Savings Inflation Bonds, more commonly referred to as I Bonds.

Currently, for bonds purchased between now and the end of October, the annualized rate of interest is 9.62%. This is an historically high rate due to the sharp rise in inflation over the past several months. The interest rate on I Bonds varies over time with changing inflation rates and compounds twice a year.

I Bond Pros

- Attractive as a fixed income hedge in periods of rising inflation

- Exempt from state and local taxes

- Federal Tax Treatment Options

- Report the interest every year

- Put off (defer) reporting the interest until you file a federal income tax return for the year in which the first of these events occurs:

- You cash the bond and receive what the bond is worth, including the interest, or

- You give up ownership of the bond and the bond is reissued, or

- The bonds stop earning interest because it has reached final maturity

- Interest earned while holding the bond is exempt from federal tax if used to pay for college expenses

I Bond Cons

- Most hold for at least one year before cashing

- Last 3 months interest penalty if:

- Cashed after 1 year holding year period

- Cashed before 5 year holding period

- Risk that inflation declines over the holding period

Current/Future I Bond Rates

KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made. For example, if you buy an I bond on July 1, 2022, the 9.62% would be applied through December 31, 2022. Interest is compounded semi-annually.

In this example, you would receive 9.62% for 6 months and assuming the new 6-month rate is 0% at the end of that time period, your annualized rate will be 4.82%. No interest would accrue and the interest penalty being the previous 3 months interest, the penalty is effectively zero.

The new interest rate beginning November 1 will likely be lower, maybe much lower since most people see inflation tapering some by the 4th quarter. We won’t know the number until it gets announced for that period.

At the end of the 6-month period, the interest rate on your bond will adjust to the current rate determined by the change in inflation calculated for the first month of the subsequent 6 month period.

Under no circumstances will there ever be a negative return.

Note: It doesn’t matter when you buy the bond during the month of issue. Interest accrues from the start of the month. For example, a bond purchased on the last day of the month, you will accrue interest as if you purchased it on the first day of the month. So, in effect, you can get 6 months interest in 5 months and 1 day.

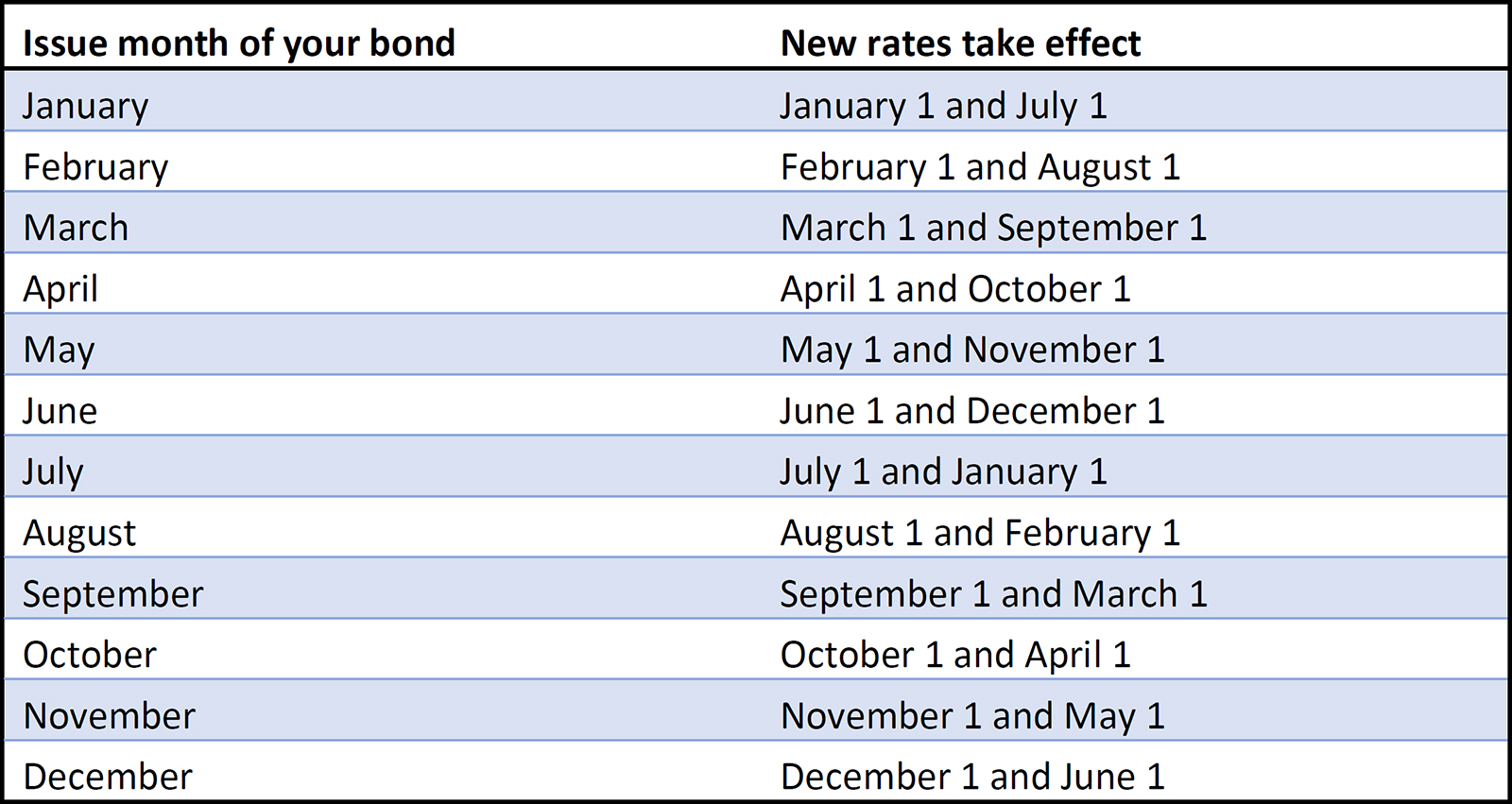

The table below shows you how that works.