Trying to understand how Social Security (SS) and Medicare (MC) are funded and how that funding may run out is not easy to explain nor is it very interesting. I am going to give it a try because the recently heightened awareness of a potential for a government debt default leading to risks that these safety net programs is putting a spotlight on what politicos in DC have been talking about for years.

Something will have to change at some point. Current estimates are that the Trust Fund that pays for SS will run out of money by 2035. Politicians on both sides of the aisle continue to play “chicken” on how to raise the debt ceiling which is not helping the situation because without a significant increase in the debt limit, risks of a government debt default and ultimate cuts to the programs only rise.

Perspective – The Annual Budget for Social Security and Medicare

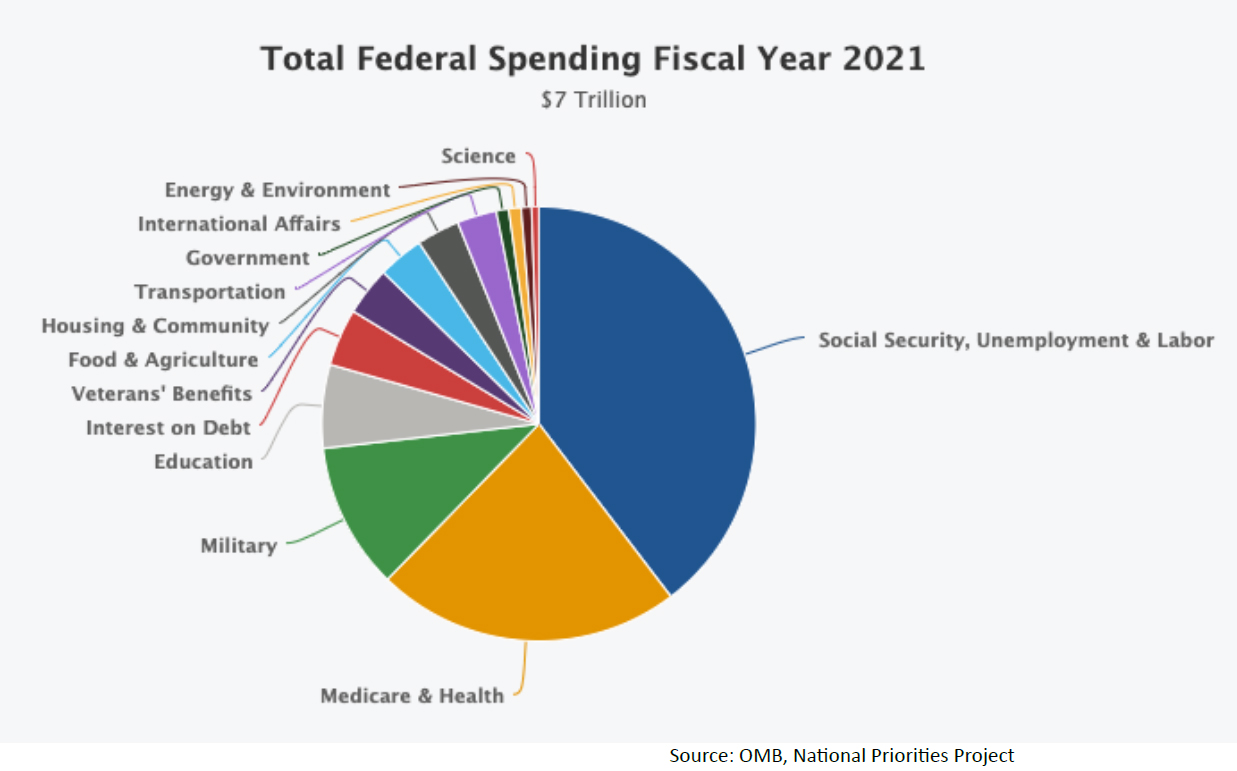

It’s good to have an understanding for just how much of our nation’s annual budget is non-discretionary and must be spent on these entitlement programs and why it matters.

The pie chart below says it all.

It’s easy to see that spending on SS and MC takes up close to 70% of the entire annual budget and that number continues to increase with no signs of slowing down. These expenditures are “mandatory”. The balance is noted as “discretionary” with defense spending safely the largest component. It gives you an idea for just how little of the annual budget Congress can play with.

A Quick History

Social Security Act

- The act was signed into law in 1935 by Franklin D. Roosevelt.

- Payouts began in 1940, well before enough funding from Payroll Taxes had been collected.

- Social Security was in a deficit as soon as it began payouts.

- To put it in perspective, the 65-year-old recipient of the historic first SS check issued, received nearly 1,000 times what she paid into the system before her death.

- While benefits stayed unchanged in the original program, Cost of Living Adjustments (COLAs) were enacted in 1975 to compensate for inflation putting additional pressure on the system.

- It is easy to assume that all early receivers of SS payments received multiples of what they contributed during their retirement years.

The SS program’s underfunded beginning has only gotten worse with each passing year increasing the debt burden on the government to fund ongoing payments. This is becoming a serious problem that Congress must address over the next several years. Increasing the debt is a nice way to “kick the can” down the road like they have been doing for decades.

Medicare

- “Original” Medicare was signed into law by President Lyndon Johnson in July 1965.

- At that time, the program provided coverage for people 65 and older:

- Part A – hospital expenses

- Part B – physician services and out-patient services not covered by Part A

In subsequent years, coverage was expanded to include:

- Medicaid – coverage for low-income individuals

- Chronic illnesses such as dialysis for kidney disease.

- Part D covering a drug benefit was added in 2003

What’s the Problem?

Aside from the fact that SS has never been truly fully funded, a structural problem is the age at which SS kicks in.

- Life expectancy when program began in 1940

- Women – 62

- Men – 58

- Life expectancy 2023

- Women – 79.3

- Men – 73.5

- The Social Security population’s changing age distribution is creating a situation in which fewer workers are paying into the system supporting a growing number of people collecting benefits

Social Security is going broke because people are simply living longer, and fewer people are paying into the system. Obviously, this fact applies to Medicare as well.

What Solutions Are Being Debated?

- Raise the Full Retirement Age

- Increases began in 1983 slowly reaching 67 yrs old for those born in 1960 or later.

- Raise the payroll tax cap – the maximum amount of wages that are taxed

- Raise the payroll tax itself

- Cut benefits for high earners – Means Testing

- Change the way benefits are calculated

There is bipartisan agreement that the situation is a dire one. Lawmakers also agree that changes to these two entitlement systems are politically dangerous if you want to get re- elected. That sort of says it all. Proposing any changes that would reduce benefits or extend the timeframe in which people can enter the system is like touching the proverbial “Third Rail”.

Wrapping Up

Odds that real changes to these two entitlement programs become law is measurable but not by much. This is not a new issue to anyone and Congress’ history of kicking the can down the road will continue.

To avoid any changes, Congress must raise the debt ceiling and do it soon or else the US Treasury will have to cease issuing debt to fund these programs as well as the entire annual budget. The game of playing chicken is in full swing now and shows no signs of resolution.

For those who are already receiving Social Security and Medicare or are close to entering those programs have little to worry about now. That can’t be said about those looking 5 to 10 years out. At some point, raising the debt ceiling every year to make up for budget shortfalls will no longer be tolerable. I believe both political parties understand that. But until the situation becomes a true crisis, both sides will continue to use the issue as a foil to attack each other purely for political purposes.