Questioning the long-term value of a college education has increasingly come into focus over the past decade or more and even more so today. It has come into the crosshairs in recent years due to the staggering amount of student loan debt currently being carried by millions of under-graduate and graduate students.

There are numerous student loan programs, both government and commercially provided, out there to consider. I will not attempt to review all of them here but rather focus on the amount of debt students are incurring during their college years and their ability, or rather inability, to pay it off through employment once having graduated. It has become apparent over the past decades that the education that many undergraduate and graduate students are gaining is not necessarily preparing them for jobs that may earn them enough to pay off their loans in a timely manner, or worse yet never being able to pay them off.

Student Loan Debt – The Numbers

Average Student Loan Debt

- $1.75 trillion in total student loan debt in 2022 (including federal and private loans)

- $28,950 owed per borrower on average

- About 92% of all student debt are federal student loans; the remaining amount are private student loans

- 55% of students from public four-year institutions have student loans

- 57% of students from private or nonprofit four-year institutions took on education debt

[Sources: Federal Reserve, The Institute for College Access and Success, College Board, MeasureOne]

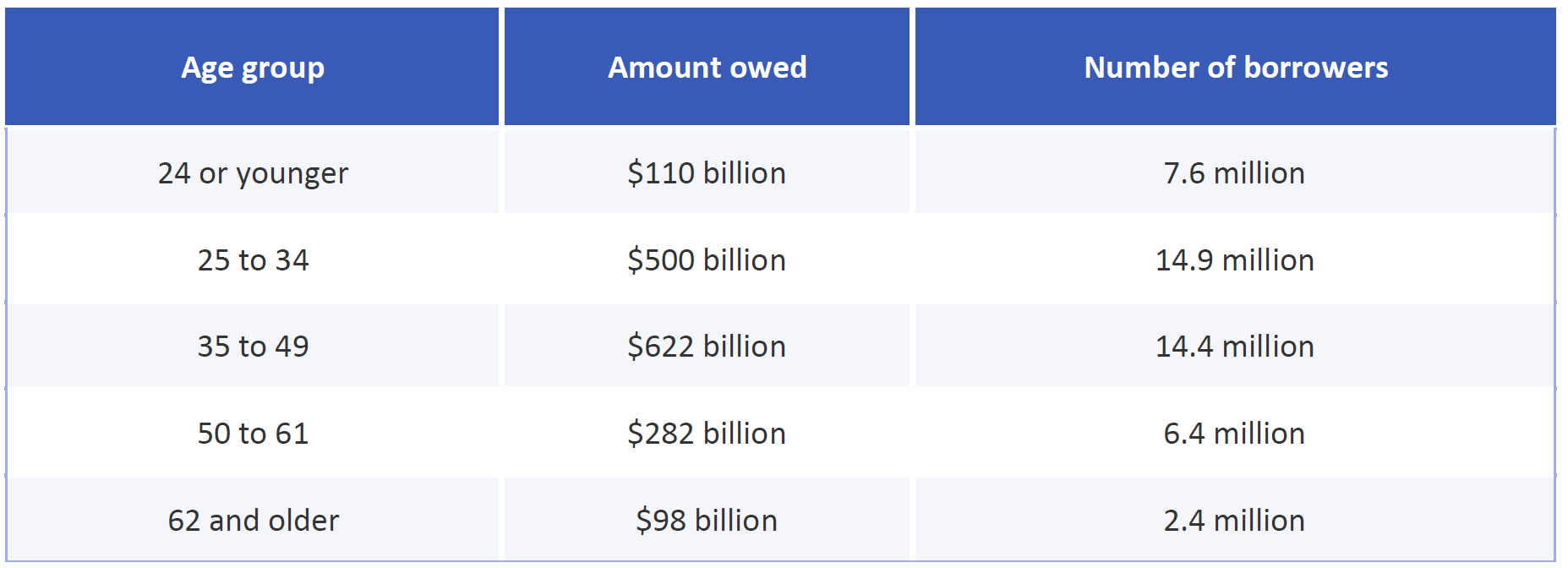

Source: Federal Student Aid

That people aged 62 and older owe as much as $98 billion surprises me. It is also striking that the average amount owed for people 24 and younger is $14,500, significantly lower than the $37,700 owed on average by people 62 and older. Much of the difference is likely tied to post- graduate education loans but it also suggests to me that the way student loans are structured allow for such small payments which only extends the time and costs it will take to pay them off in full, not unlike the way credit card payment plans work.

Historical Trends in College Tuitions & Fees

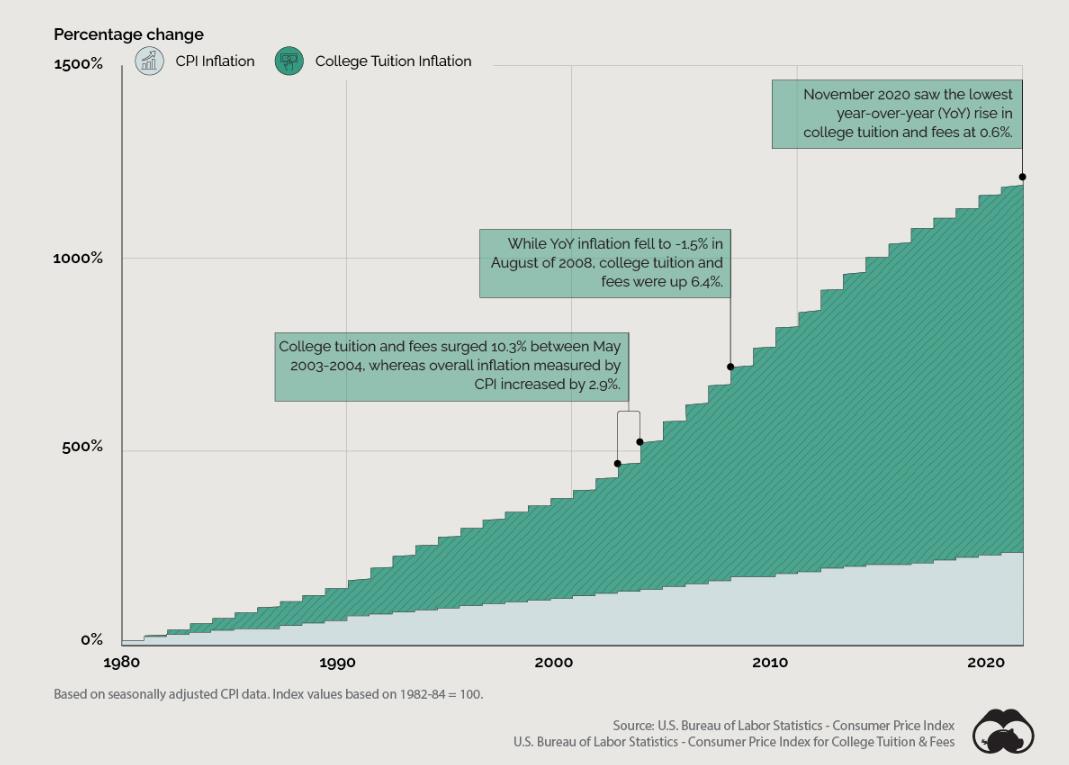

The graph below illustrates what we all know which is costs of going to college have increased annually well above the Consumer Price Index (CPI) for decades.

There are many factors cited that have driven costs higher than inflation. As entry-level jobs increasingly require undergraduate degrees, colleges are competing with each other and, as a result, are making changes on campus to increase the value of the student experience. Building more dorms, hiring more faculty, investing more in technology are a few of the most commonly cited factors. Lastly on the cost front, public institutions have been suffering from reduced state funding as state budgets get squeezed by other spending priorities.

On a cynical level, there is a theory out there called the Bennett Hypothesis put forth in 1987 by then Education Secretary, William Bennett. It suggests that as student loans have become so ubiquitous, colleges have arbitrarily raised tuitions to the maximum amount students are legally allowed to borrow. Many studies have since tried to prove or disprove his hypothesis resulting in a surprising lack of consensus so theory cannot be fully ignored.

How Valuable is a College Degree?

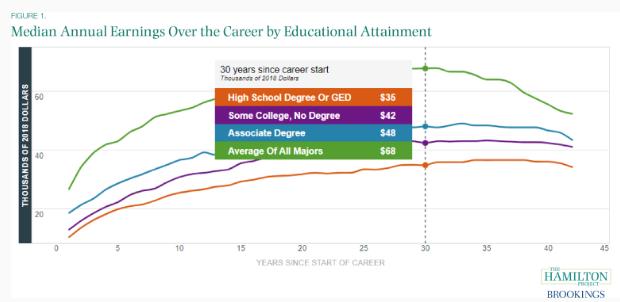

The chart below is a very generalized analysis of annual earnings related to levels of education. There is obvious logic in the conclusion that the more education one achieves leads to higher income. A lot of assumptions in there but it generally holds true. The green line averages all types of college majors which smooths out what would otherwise be a wide variety of earnings among different majors.

Focusing on incomes related to different bachelor’s degree programs tells us a lot about the ultimate value of going to college and can help students decide what degree programs may benefit them the most and give them a better shot of paying off their student debt.

The Brookings Institution has done extensive analysis of available data to try and determine the “value” of different degree programs. Their goal is an attempt to create a list of “low-financial- value” programs, those programs where the total costs exceed the financial benefit provided, and “high-financial-value” programs which provide a better shot of paying off student debt. The research is currently ongoing with the results due out later this summer. The thrust of the effort, driven by the Department of Education, is to help prospective college students determine which colleges offer the highest value programs that fit their preferred area of study. In other words, the desired programs that would incur the least amount of student debt and provide the most valuable education thereby improving the chances of being able to pay off such debt in a timely manner.

Should Colleges Be Held Accountable?

There is growing criticism of higher education institutions that are offering too many associate and bachelor’s degree programs that saddle students with levels of debt that are far out of proportion to the income they earn after leaving their program. It can be argued that some of

these degree programs may provide non-economic value. Some feel, and I agree, that colleges bear some responsibility for focusing on degree programs that prepare students with the skills to be able to pay off their student loans and pursue fruitful careers. This is especially true for borrowers that attend graduate programs where debt-to-income ratios rise well above sustainable levels.

Student Debt Forgiveness?

Prior to the pause on repayment, interest, and debt collection as part of the response to the COVID-19 pandemic, more than 1 million borrowers defaulted on their student loans each year, and millions more borrowers were behind on their student loan payments. When this happens, taxpayers end up shouldering the cost.

The Biden Administration’s Student Loan Forgiveness Program was blocked by two lower federal courts following legal challenges last fall. The Supreme Court took up the case and held a hearing on it this past February. A majority of the justices appeared to express skepticism during questioning that such an executive order was a proper exercise of executive authority. A decision is expected in June.

Wrapping Up

The decision to pursue a post-secondary education is ultimately and obviously a personal one. Current costs to attend college are high but in fact have begun to decline ever so slightly over the past several years with further declines during and post the pandemic. There are notable instances of smaller, non-public colleges simply closing up shop due to declining enrollment. I expect that trend will continue. As we develop financial plans for our clients, our focus is on charting a path for long term financial security. By all means, we are not the ones to opine on whether someone should pursue a post-secondary education or not but rather our focus is on helping you achieve your goals, whatever they may be.